Turbos are complex instruments and come with a high risk of losing money rapidly due to leverage. 7 out of 10 retail investor accounts lose money when trading turbos. You should consider whether you understand how turbos work and whether you can afford to take the high risk of losing your money.

About us

Website

Documents

Products

Trading

LIBOR Transition

Frequently Asked Questions (FAQs) on the transition of LIBOR interest rates and impacts on Turbo Certificates and Trader Certificates

Status: 8 December 2021

Below information is intended for investors or prospective investors in leveraged products of Goldman Sachs Bank Europe SE or Goldman, Sachs & Co. Wertpapier GmbH and is provided for information purposes only. Only the documents referred to in these FAQs are legally binding.

1. What is the background?

On 5 March 2021 the UK Financial Conduct Authority (FCA) announced the future cessation and loss of representativeness of the LIBOR interest rate. Pursuant to the announcement all 7 euro LIBOR settings, all 7 Swiss franc LIBOR settings, the Spot Next, 1-week, 2-month and 12-month Japanese yen LIBOR settings, the overnight, 1-week, 2-month and 12- month sterling LIBOR settings, and the 1-week and 2-month US dollar LIBOR settings will cease immediately after 31 December 2021. The publication of the overnight and 12-month US dollar LIBOR settings will cease immediately after 30 June 2023.

Regulatory authorities and central banks are strongly encouraging the transition away from LIBORs and have identified "risk-free rates" (RFRs) to replace LIBORs as primary benchmarks.

Since 7 May 2021 Goldman Sachs already uses RFRs as reference rate for newly issued Turbo Certificates and Trader Certificates and to that extent no longer refers to LIBOR rates.

For outstanding products issued by Goldman Sachs prior to 7 May 2021 that still use a LIBOR rate as reference rate, Goldman Sachs will replace the applicable LIBOR rate by the corresponding RFR as of 1 January 2022 pursuant to the conditions applicable to those products in the light of the upcoming cessation of various LIBOR rates as of 31 December 2021.

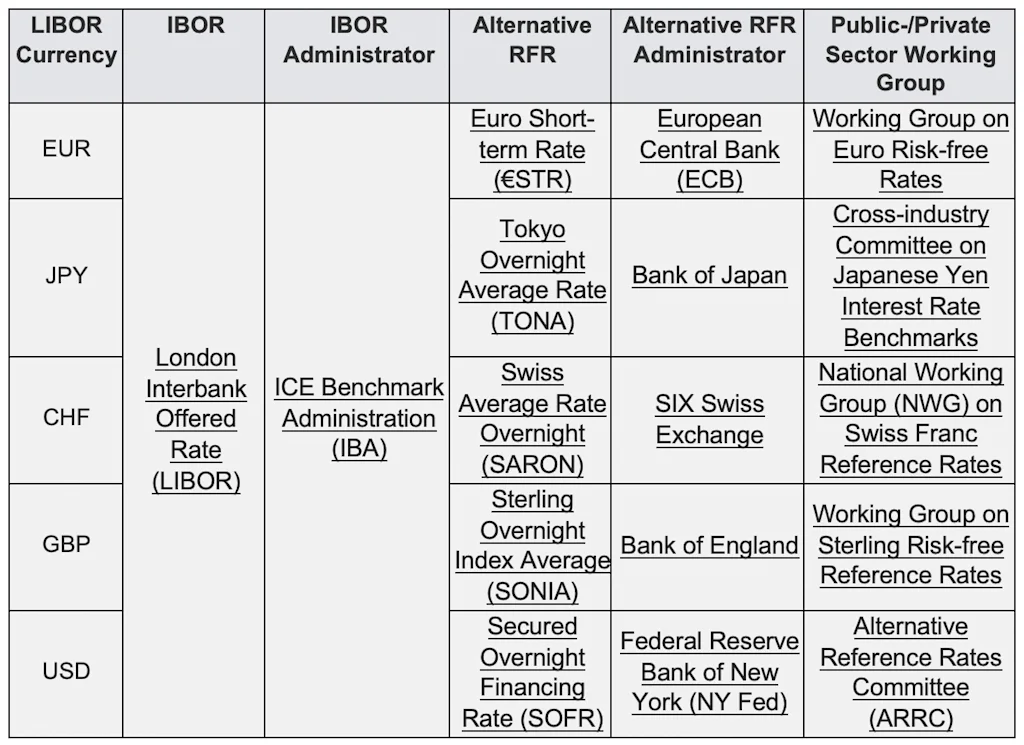

2. What are the new risk-free rates (RFRs) that will replace the respective LIBOR interest rates?

National working groups of market participants, central banks, and regulators have recommended the following RFRs which Goldman Sachs is going to apply going forward instead of the corresponding LIBORs:

3. How are structured products issued by Goldman Sachs affected by such change in LIBOR interest rates?

Turbo Certificates and Trader Certificates are adjusted on any adjustment day (in general any business day) and in the course of such adjustment the financing rate of the respective product is taken into account. The financing rate consist of an interest margin determined by Goldman Sachs and a reference rate specified in the relevant final terms. The reference rate is usually a short-term/overnight interest rate in the currency of the underlying. For products issued prior to 7 May 2021 Goldman Sachs has used the respective LIBOR rate in the currency of the underlying (e.g. for shares denominated in EUR the EUR LIBOR).

For Turbo Certificates and Trader Certificates issued since 7 May 2021 Goldman Sachs already applies the respective RFRs as relevant reference rate (e.g. for shares denominated in EUR the €STER). Due to the different calculation methods of the RFRs and the LIBORs it should be noted that there may be differences between the RFRs and the respective LIBOR interest rates and Turbo Certificates and Trader Certificates taking the RFRs into account may not develop in the same manner as corresponding products where a LIBOR rate is the relevant reference rate.

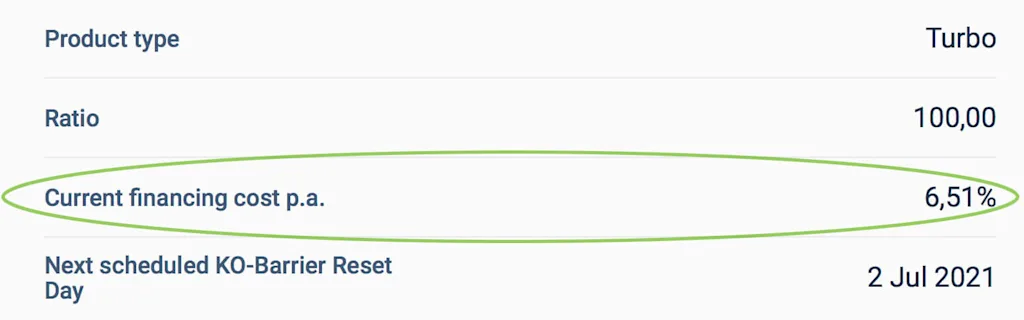

You can see the total financing costs, compromised of the financing spread and the reference rate, on the each of the product pages of Goldman Sachs products (see screenshot).

4. Will this only affect new products or also existing products?

Since 7 May 2021 Goldman Sachs only uses the respective RFR as relevant reference rate for all newly issued Turbo Certificates and Trader Certificates.

For outstanding products issued by Goldman Sachs prior to 7 May 2021, the relevant LIBOR rate continues to be used as the reference rate to date. In the light of the upcoming cessation of various LIBOR rates as of 31 December 2021, Goldman Sachs will replace the relevant LIBOR rate used as the reference rate for the respective product by the corresponding RFR pursuant to the conditions applicable to the respective products as of 1 January 2022. In this regard, Goldman Sachs has published separate notices regarding the replacement of the respective LIBOR rate as reference rate on 8 December 2021, which list the products affected by the replacement by ISIN and contain further information about the respective RFR and the relevant replacement provision in the conditions of the products. The respective notices are available under

www.gsmarkets.nl/en/services/documents/ announcements (for investors in Luxembourg and The Netherlands)

www.gsmarkets.fr/en/services/documents/ announcements (for investors in France)

www.gsmarkets.be/en/services/documents/ announcements (for investors in Belgium)

and are also included in the appendix to these FAQs.

5. What is the impact of replacing the relevant LIBOR rate by a RFR, on products issued prior to 7 May 2021?

Due to the different calculation methods of the RFRs and the LIBORs it should be noted that there may be differences between the RFRs and the respective LIBOR rates and Turbo Certificates and Trader Certificates taking the RFRs into account may not develop in the same manner as corresponding products where a LIBOR rate is the relevant reference rate.

In particular, investors should be aware that it is not possible to anticipate whether the RFR will at the time of replacement of the reference rate be higher or lower than the LIBOR rate and this could therefore lead to a higher or lower interest rate being charged to the investors. In order to keep the impact of the replacement of the reference rate as low as possible for investors, Goldman Sachs will use the RFR recommend by national working groups of market participants, central banks, and regulators for the respective LIBOR rate as of 1 January 2022.

Investors should consider the impact that any such replacement might have on the products and determine whether they would like to sell back their product at prevailing market rates ahead of the replacement of the reference rate, or if instead they will prefer to remain invested in the product.

Appendix: List of notices

For investors in Luxembourg and The Netherlands:

Products of Goldman, Sachs & Co. Wertpapier GmbH:

Replacement of ICE EUR Overnight LIBOR by the Euro Short-term Rate (€STR) as Reference Rate

Products of Goldman Sachs Bank Europe SE (originally issued by Goldman, Sachs & Co. Wertpapier GmbH):

Replacement of ICE EUR Overnight LIBOR by the Euro Short-term Rate (€STR) as Reference Rate

For investors in France:

Products of Goldman, Sachs & Co. Wertpapier GmbH:

Replacement of ICE EUR Overnight LIBOR by the Euro Short-term Rate (€STR) as Reference Rate

Products of Goldman Sachs Bank Europe SE (originally issued by Goldman, Sachs & Co. Wertpapier GmbH):

Replacement of ICE EUR Overnight LIBOR by the Euro Short-term Rate (€STR) as Reference Rate

For investors in Belgium:

Products of Goldman, Sachs & Co. Wertpapier GmbH:

Replacement of ICE EUR Overnight LIBOR by the Euro Short-term Rate (€STR) as Reference Rate

Products of Goldman Sachs Bank Europe SE (originally issued by Goldman, Sachs & Co. Wertpapier GmbH):

Replacement of ICE EUR Overnight LIBOR by the Euro Short-term Rate (€STR) as Reference Rate